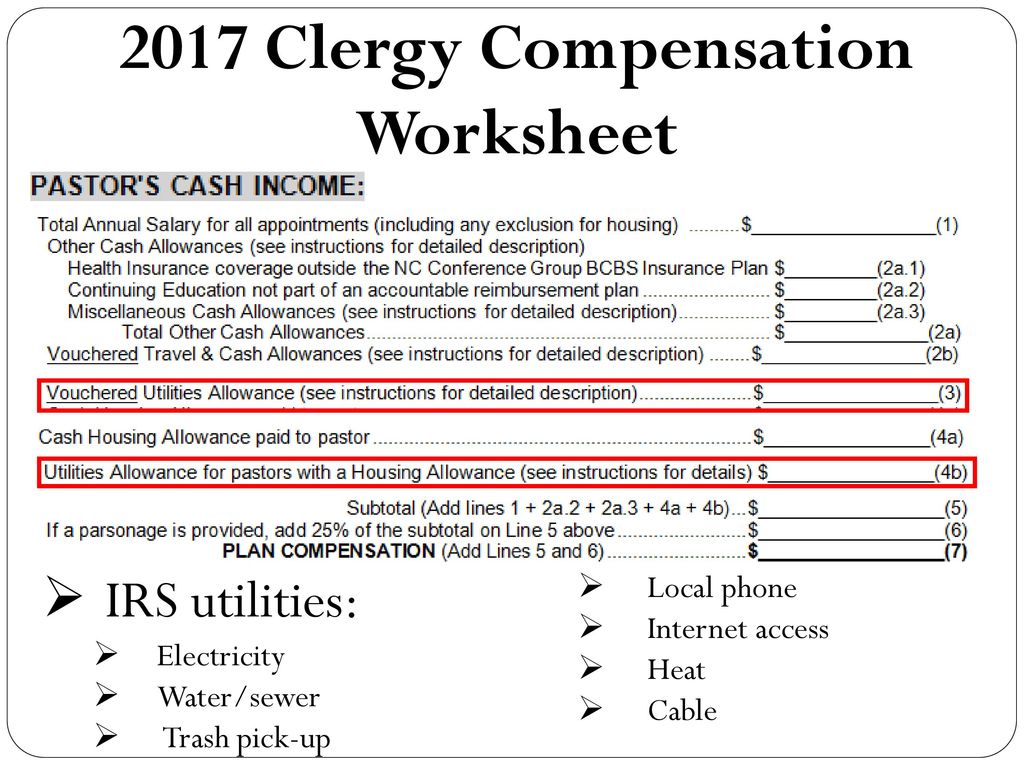

housing allowance for pastors worksheet

2020 Minister Housing Allowance Worksheet Mortgage Payment Real Estate Taxes Homeowners Insurance Mortgage Down Payment Closing Costs Rent Renters Insurance. Follow the step-by-step instructions below to design your pastors housing allowance worksheet.

Christine Dodson Joanna Ezuka Caroline Thornton Ppt Download

Remember the tax code limits the nontaxable portion of housing compensation designated as.

. A worksheet is provided for the ministers use upon request. Heres a link to the form. If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their.

Not every staff member. Housing allowance designated by the church or other employer. CLERGY HOUSING ALLOWANCE WORKSHEET METHOD 2.

In that case at most 5000 of the 10000 housing allowance can be excluded from the pastors gross income in that calendar year. Ministers Housing Allowance Worksheet Approval The housing allowance. Taxes with housing allowance Salary of 50000 Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed.

One for a pastor who lives in a manse one for a pastor who rents and one for a pastor. Housing Allowance For Pastors Worksheet. Down payment on purchase of primary residence Mortgage payments on.

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE. Amount actually spent for housing this year. Housing allowance for ministers who own their home to the fair rental value of the home.

The payments officially designated as a housing allowance must be used in the year received. The preferred way to do this is for the church councilboard to. Here are four important things that you need to know concerning the housing allowance.

Housing Manse Parsonage Designation. CLERGY HOUSING ALLOWANCE WORKSHEET METHOD 1. The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing.

For this reason RBI has three online housing allowance worksheets available for you. Find free wordpress themes and pluginshousing manse. The housing allowance is for pastorsministers only.

This worksheet is provided for educational purposes only. A pastors housing allowance must be established or designated by the church or. Officially designated in advance housing allowance.

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self. You should discuss your specific. Select the document you want to sign and click Upload.

Add 765 of the. Include any amount of the allowance that you cant exclude as wages on line 1 of. Recognizing that the pastor is self-employed for purposes of Social Security some congregations choose to add to the salary an amount equal to half the self-employment tax.

Housing Allowance For Ministers Cbf Church Benefits

Housing Allowance For Pastors Clergy Housing Allowance Mmbb

Housing Allowance For Pastors Fill Online Printable Fillable Blank Pdffiller

Everything Ministers Clergy Should Know About Their Housing Allowance

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Ultimate Guide To The Housing Allowance For Pastors Reachright

Pastoral Housing Allowance For 2021 Geneva Benefits Group

Should Pastors Tithe On Housing Allowance Fishbowl Family

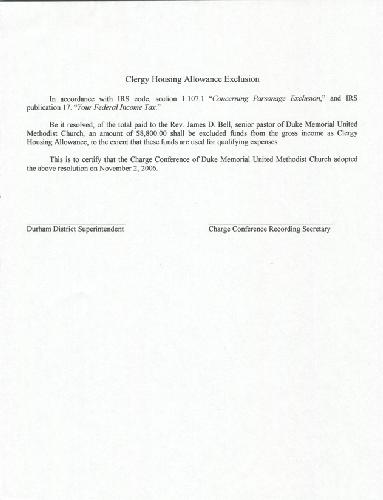

Clergy Housing Allowance Exclusion

What Is Housing Allowance For Ministers Envoy Financial

2020 Housing Allowance For Pastors What You Need To Know The Pastor S Wallet

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

Q A Can A Church Reject The Housing Allowance Amount A Church Law Tax

Ministerial Payroll Miller Management

Solved As A Pastor Filing As A Contractor Is My Mileage To Be Under Personal Deduction Credits Tab Or Business Expenses I Have No 1099 My Income Is Housing Allowance Only